Businesses Seek Higher GST Limit for Small Players

HYDERABAD: The business community sought raising of the GST registration threshold in the state from Rs 20 to Rs 40 lakh

GST on aerated beverages may be hiked to 35%; GST council decision on Dec 21

The GoM on GST rate rationalisation has proposed increasing the tax on aerated beverages to 35% from 28% and similarly r

ITC shares dip 1.5%on potential GST rate increase on tobacco products

GST Council likely to recommend rate increase on tobacco, tobacco-related products from 25% to 35%

Varun Beverages shares slip over 5% as GST on aerated beverages may be hiked to 35%

Shares of Varun Beverages fell by 5.2% as the Group of Ministers proposed raising the GST rate on aerated drinks to 35%.

ITC shares fall 3% as GST on cigarettes may be hiked to 35%

ITC share price: Shares of companies like ITC and Godfrey Phillips fell as the GoM decided to increase GST on tobacco an

GST rate overhaul: GoM to propose revisions for 150 items, report on Dec 21

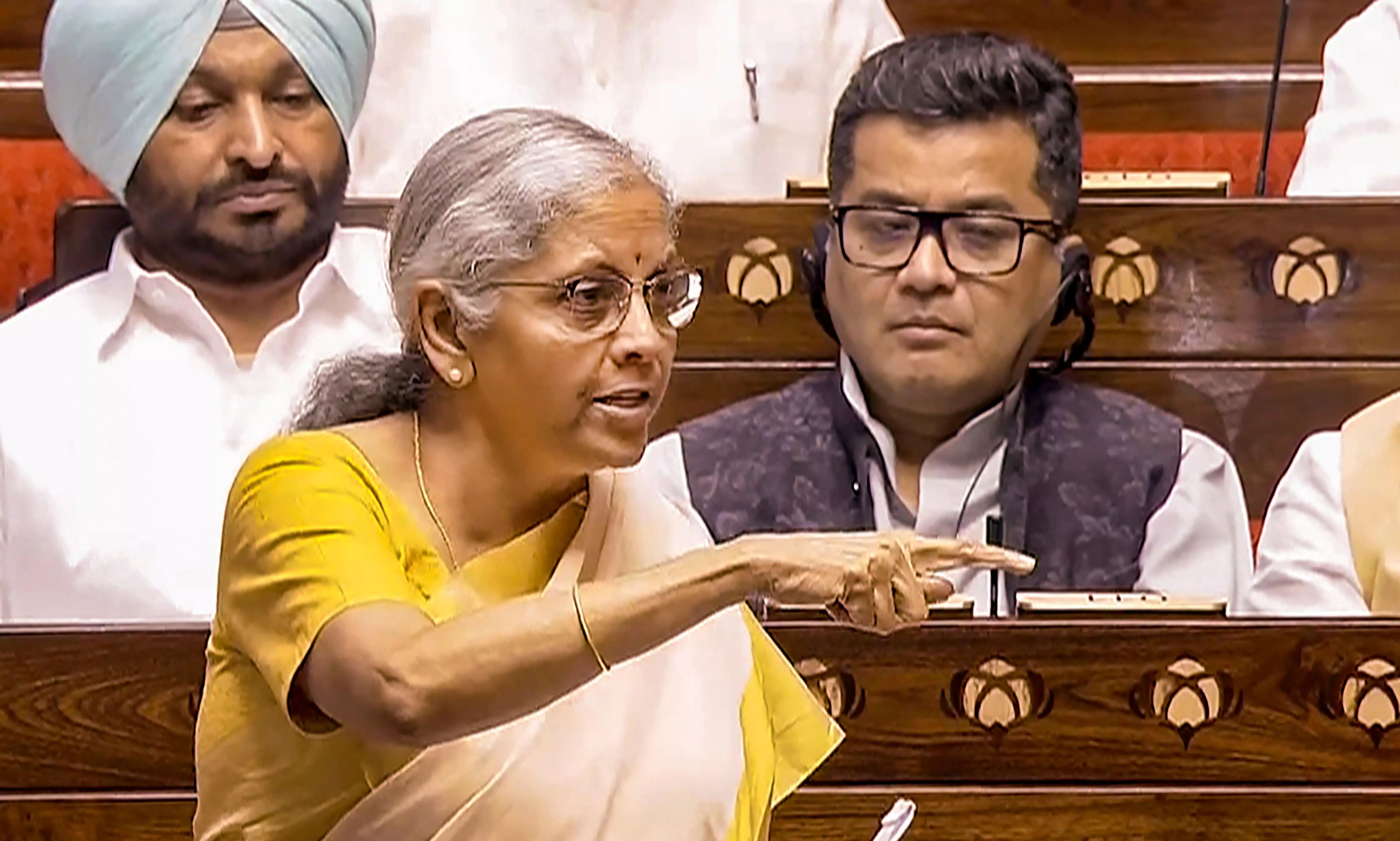

The GST Council, chaired by Finance Minister Nirmala Sitharaman, will review the recommendations in its 55th meeting in

Up to 75 pc of GST revenue comes from 18 pc slab: MoS Finance

Around 70-75 percent of GST revenues in 2023-24 came from the 18 percent slab. Only 5-6 percent was from the 12 percent

Cost of health, life insurance to come down if GST Council decides to reduce taxes on premium: FM

Finance Minister Nirmala Sitharaman stated that insurance costs may decrease if the GST Council suggests lowering GST ra

GST spurring fresh tax terrorism, says former CEA Arvind Subramanian

Former Chief Economic Adviser Arvind Subramanian laments the GST Council has become a rate cutting and exemption grantin

Finance Ministry rethinks windfall tax; Oil Ministry for natural gas under GST

The finance ministry is assessing the windfall tax on petrol, diesel, and aviation fuel exports. It is also considering

December meeting of GST Council likely to consider GST on natural gas

The GST Council will recommend the date on which the goods and services tax be levied on petroleum crude, high speed die

GST Council to Review GoMs Insurance Tax Suggestions Soon

The Insurance Regulatory and Development Authority of India (IRDAI) and the General Insurance Council would be formally

Finance Ministry Clarifies GST Exemption On Health And Life Insurance Policies

The issue of extending GST exemptions to more health and life insurance products was discussed at the 54th GST Council m

FICCI seeks GST cuts on EV batteries,charging services to boost affordability

NEW DELHI, Nov 19:In order to keep EVs competitive there is a need to reduce GST on batteries and charging services, FIC

GST Council to meet in Jaisalmer on Dec 21; may decide on insurance levy, rate rationalisation

New Delhi : The GST Council will meet on December 21 in Jaisalmer, in which the much-awaited decision on exemption or lo

GST Council to hold 55th meet on Dec 21 in Jaisalmer

The 55th meeting of the GST (Goods and Services Tax) Council will be held on December 21 in Jaisalmer, Rajasthan.

Nirmala to meet State FMs on Dec 21, 22

Excelsior Correspondent Jammu, Nov 12: Union Finance Minister Nirmala Sitharaman is likely to meet her state counterpart

Nirmala Sitharaman to begin pre-budget consultation with state FMs in December

GST Council meeting is expected to be held during either on Dec. 21 or 22 in which the much awaited decision on exemptio

Budget 2025: Nirmala Sitharaman to meet state FMs for pre-Budget, GST Council meet on Dec 21-22

Finance Minister Nirmala Sitharaman is set to meet with state counterparts on December 21-22 for pre-budget discussions

The GST Council is likely to consider lowering the tax rate on certain insurance plans, including potentially eliminatin

Sanjeev Ahluwalia | Looking beyond the fog of short-term results

Most institutions in India are characterised by short-termism -- privileging near-term results over long-term trends and

Rate rationalisation exercise: Luxe bags, cosmetic treatments may be moved to 28% GST Slab

The GST Council's GoM is considering moving 58 goods and 24 services, including luxury handbags, sunglasses, and cosmeti

GST on term life insurance premium, senior citizen's health coverage may be exempt

New Delhi: Goods and services tax (GST) on term life insurance premiums, and premium paid by senior citizens for health

GoM suggests higher GST rates for premium products, relief for senior citizens' health insurance

A group of ministers (GoM) examining Goods and Services Tax (GST) rates has proposed moving certain premium shoes and wa

GoM decides to cut GST on 20-litre water bottles, bicycles to 5%; raise rate on shoes, watches

The GoM on GST rate rationalisation has proposed lowering tax rates to 5% on 20-litre packaged drinking water bottles, b

Ministerial Panels to Discuss GST Rate Rationalisation on Insurance Premiums Today

New Delhi: Two ministerial panels formed by the GST Council will convene today, October 19, to deliberate on the rationa

Panels on GST rate rationalisation, cutting tax on insurance premium to meet on Saturday

The GST Council's ministerial panels will meet on October 19 to discuss reducing the 18 per cent GST on health and life

GST compensation cess to be discussed at GoM meeting on Wednesday

During the 54th GST Council meeting on September 9, Finance Minister Nirmala Sitharaman indicated that the government pl

GST Anti-Profiteering Clause To Expire From April Next Year

The GST Council in June recommended amendment to CGST Act provisions to provide a sunset clause of April 1, 2025, for an

India's GST Council Forms GoM to Review Luxury Tax Post-Cess

GST Council forms GoM to propose tax on luxury, sin, and demerit goods after cess ends in March 2026

GST Council forms GoM on compensation cess; report expected by Dec 31

The Goods and Services Tax (GST) Council has set up a 10-member GoM, chaired by Minister of State for Finance Pankaj Cha

GST Council Forms GoM To Determine Taxation On Luxury And Sin Goods Post-Cess

With just one-and-a-half year remaining for the cess to end, the GST Council in its 54th meeting on September 9 decided

GST Council sets up GoM on compensation cess; panel to submit report by Dec 31

New Delhi: The Goods and Services Tax (GST) Council has set up a 10-member GoM, chaired by Minister of State for Finance

GoM on GST on health, life insurance premium to meet on Oct 19

NEW DELHI, Sept 26: The Ministerial panel to decide on lowering goods and services tax (GST) on health and life insuranc

GST rate rationalisation: GoM discusses pruning 12% slab, next meeting on October 20

West Bengal has suggested that the decision taken at the 23rd meeting of the GST Council in which tax rates were slashed

GST rate rationalisation: Tax tweaks for over 100 items discussed, next meeting on Oct 20

NEW DELHI: The GoM on goods and service tax rate rationalisation , convened on Wednesday has discussed tax rate tweaks f

Consensus eludes GoM on GST rate rationalisation, over 100 items discussed

The outcome of the rate rationalisation discussions will be crucial in shaping the agenda for the upcoming 55th GST Coun

GST Council to Finalise Tax Rates

New Delhi: A report focusing primarily on tax slabs and rates in health and life insurance premiums and GST rate rationa

Design architecture for B2C e-invoicing for retailers ready: GSTN CEO

The design architecture for implementing GST e-invoicing for retailers is mostly ready and being vetted by industry expe

Two-day GST Summit in Goa: GoM to review tax rates for 100+ products

The recommendations from this panel will serve as the foundation for a report to be presented at the 55th GST Council me

GST cess extension: Is it Justified Beyond 2026?

With loans likely to be repaid by January 2026, the question arisescan the continued levy of the cess be logically justi

GoM on GST rate rationalisation to discuss slab, rate tweaks on Sep 25

The ministerial panel on GST rate rationalisation will meet on September 25 and is expected to discuss tweaking of tax s

GST Council Meeting: Centre-State IGST Panel To Address Negative Balance Issue

The IGST meeting follows the 54th GST Council meeting on Sept. 9, which discussed the negative balance issue.

Has GST Council Reduced Tax Rates on Life and Health Insurance? A Fact-Check

The council has not yet announced any reduction in both the insurances.

GST Council forms GoM to review tax rate on insurance; report by Oct 30

The GST Council on Sunday constituted a 13-member Group of Ministers (GoM) to suggest GST rate on premiums of various he

GST Council forms GoM to review tax rate on health, life insurance; report by Oct 30

The GST Council has formed a 13-member Group of Ministers to recommend GST rates on health and life insurance premiums.

Annamalai apologises as Oppn parties slam BJP over hotel chain owner apology video

Chennai: Tamil Nadu BJP chief K Annamalai on Friday apologised for the action of his party functionaries in sharing on s

Punjab Finance Minister Seeks GST Compensation At 54th GST Council Meeting

Therefore, considering the low GST revenue, the council must look at ways to compensate states that are losing revenue d

Sitharaman-led GST Council has a key task now to develop a long-term vision for tax

The GST Council's 54th meeting addressed industry concerns by rationalizing GST rates, providing exemptions, and clarify

The Council decided to reduce the GST rate on cancer drugs Trastuzumab Deruxtecan, Osimertinib and Durvalumab from 12% t

Soothing salvo: on new Group of Ministers and tax changes for insurance policies

The GST Council has held out hope for some relief for insurance consumers

Key decisions ahead for GST Council: Rate cuts, slabs, compensation cess

The challenge will be to rationalise rates and adjust the part which is now collected as cess in a manner that makes the

Insurance shares trade weak; HDFC Life, SBI Life, ICICI Pru shed up to 4%

The GST Council has announced the formation of a new Group of Ministers to review the issue of GST rate reduction on hea

GST council gave nod on exempting research grants from GST net: Atishi

GST council cuts tax on select cancer medications, namkeens and shared helicopter rides

Powered by Capital Market - Live News

GST reduction on cancer drugs to make life-saving meds more affordable: Experts

Shillong, September 10: Welcoming the GST Councils reduction in tax rates on essential cancer drugs, experts on Tuesday

GST Council spices things up: Here's what got cheaper overnight in India

GST Council Meeting decisions: The GST Council's meeting on Monday announced significant tax cuts to make essential good

Bikaji, Gopal Snacks stocks get tastier after GST council cuts rate; up 8%

Gopal Snacks and Bikaji Foods share price rallied after GST Council slashed GST rates from 18 per cent to 12 per cent

GST Council slashes cancer drug tax, reduces rates on snacks and air conditioning machines

Additionally, the GST rate on extruded namkeen snacks has been lowered from 18% to 12%. To promote research and innovati

GST Councils 54th Meeting Brings Major Reforms in Healthcare, Online Gaming, and Tax Structure

The 54th meeting of the Goods and Services Tax (GST) Council, led by Union Finance Minister Nirmala Sitharaman, conclude

GST Council Introduces Reverse Charge Mechanism On Metal Scrap

The Council stated that if a business is selling metal scrap and is not registered for GST, it will not need to charge b

GST Council cuts tax on religious air travel

NEW DELHI, Sept 9: Uttarakhand Finance Minister Prem Chand Agarwal on Monday said the GST Council has decided to cut tax

GST council's nod on exempting research grants victory for nation: Atishi

Delhi Finance Minister Atishi on Monday said the GST Council has decided to exempt research grants from the GST net, and

GST Council Cuts Rates on Cancer Drugs, Namkeen; Defers Health Insurance Decision

New Delhi: The goods and services tax (GST) Council, chaired by Union finance minister Nirmala Sitharaman, on Monday ann

Bhatti Seeks Lower GST on Health Insurance

Hyderabad: Deputy Chief Minister and finance minister Mallu Bhatti Vikramarka on Monday urged the Centre to not levy Goo

GST Council Exempts Foreign Airlines From GST On Import Of Services

In its 54th meeting, the Goods and Services Tax (GST) Council announced an exemption for foreign airline companies from

GST Council sets up GoMs on health, life insurance, compensation cess

Relief to foreign airlines, secretaries panel on IGST

GST Council Meeting: Here Are Key Highlights

GST rates on specified cancer drugs have been reduced from 12% to 5%.

Arunachal Deputy CM seeks GST exemption for research grants

Arunachal Pradesh Deputy Chief Minister Chowna Mein has requested that research grants received by universities and inst

Group Of Ministers To Look Into GST Rate Cut Demand On Health Insurance: Nirmala Sitharaman

GST Council headed by Union Finance Minister Nirmala Sitharaman on Monday decided to set up a Group of Ministers (GoM) o

54th GST Council meet: New GoM to look into rate on life, health insurance

The issue of taxation of insurance premiums had figured in Parliament discussions with Opposition members demanding that

GST Council Sets Up GoM On Reduction In GST On Health Insurance; Cuts Rate On Cancer Drugs

New Delhi, Sep 9: GST Council headed by Union Finance Minister Nirmala Sitharaman on Monday decided to set up a Group of

Namkeens to get cheaper as Centre announces GST cuts

At the 54th GST Council meeting on Monday, the Centre decided to cut down on the cost of namkeen and savoury products, a

GST Council moves closer to reducing GST on life, health insurance premiums

Shares of major insurance companies like Star Health, ICICI Lombard General Insurance, and Go Digit General Insurance tr

Tax on helicopter services for religious travel down at 5%: Uttarakhand FM

Uttarakhand Finance Minister Prem Chand Agarwal on Monday said the GST Council has decided to cut tax on helicopter serv

GST Council defers announcement on insurance premiums, matter to be taken up in next meeting

GST on Health Insurance: The GST Council has postponed a decision on reducing the GST rate for health and life insurance

GST Council Meeting Live: Tax On Shared Helicopter Services Cut, Says Uttarakhand Minister

The GST Council is chaired by Finance Minister Nirmala Sitharaman and comprises of state ministers.

In pics GST Council meeting: 09-09-2024

New Delhi: Union Minister for Finance and Corporate Affairs, Nirmala Sitharaman chairs the 54th meeting of the GST Counc

Uttarakhand Finance Minister Premchand Aggarwal stated that the GST Council did not reach a decision on imposing 18% GST

GST Council meet to focus on medical insurance premium, rate rationalization

With an aim to ensure less burden on the taxpayers, the 54th GST Council meeting is likely to deliberate on a slew of is

Online gaming industry eyes relief as stakeholders await GST Council review

GST Council Meet: The gaming industry is hopeful that the meeting will address concerns over issues such as valuation, r

Will oppose GST on online transactions under 2000, research grants: Atishi

New Delhi: Delhi Finance Minister Atishi on Monday said they will oppose the Centre's proposal to impose GST on online t

Will oppose GST implemented on health insurance: Delhi Minister Atishi on GST Council meeting

Delhi Minister Atishi stated that the Delhi and Punjab governments will oppose the imposition of GST on research grants

FM Sitharaman-led GST Council meet begins; Here are the key expectations

The 54th GST Council meeting, led by Finance Minister Nirmala Sitharaman and attended by state ministers, commenced on M

GST Council set to meet today, talks on rate rationalisation to kick off

GST Council Meet: The Goods and Services Tax (GST) Council is expected to deliberate on a host of issues on Monday, incl

The 54th GST Council meeting on Monday is expected to make a key decision regarding the GST rate on health insurance pre

GST council meeting today to discuss tax reforms

The council is expected to discuss reducing the current 18% GST rate on life and health insurance premiums. This could r

Delhi to oppose GST on online payments below 2,000: Atishi

Proposal likely to come up for discussion at GST Council meeting today;18% tax on all online transactions to hit consume

Will raise GST issue on research grants in council meet: Delhi FM

Delhi Finance Minister Atishi on Sunday said she will raise the issue of imposition of GST on research grant procured by

India's GST Council to discuss tax on insurance, gaming levy

GST Council to address key taxation issues, including insurance premiums and online gaming levy, amid growing concerns

GST Council to deliberate on taxation of insurance premium, report on online gaming

Sources claimed the fitment committee, comprising Centre and State tax officials, will present a report on GST levied on

GST Council to deliberate on taxation of insurance premium, online gaming

The deliberations will also happen with regard to the goods and services tax (GST) cut on life insurance premium

GST cut on health insurance: You may not celebrate a likely tax cut this time

The GST Council is set to discuss reducing the high GST on health and life insurance policies. While there's consensus o

K'taka govt urges PM to abolish 18% GST on health insurance premiums

The Karnataka government on Friday urged Prime Minister Narendra Modi to advise the GST Council, which is set to meet on

Karnataka urges Centre to reconsider 18% GST on health insurance

In a letter to Prime Minister Narendra Modi, Karnataka Health Minister Dinesh Gundu Rao urged him to recommend to the GS

Karnataka min writes to PM to reconsider 18 pc GST on health insurance

Bengaluru: Karnataka health minister Dinesh Gundu Rao on Friday, September, 6 shot off a letter to Prime Minister Narend

Health insurance GST: Indian states may be blocking the way for a big tax relief

Health Insurance Tax: The GST Council is set to discuss reducing the tax burden on health and life insurance policies, b

GST Council may decide on tax treatment of life, health insurance

Fitment panel suggests four options to Council with revenue implications

Biocon Hits 30-Month High On Report GST Council May Cut Cancer Drugs Tax

The 54th GST Council meeting on Sept. 9 is likely to provide relief to cancer drugs like Trastuzumab Deruxtecan, Osimert

GST Council meeting: E-invoice mandate may soon cover B2C transactions

Pilot run on voluntary basis for selective sectors

GST Council to meet on Sept 9; compensation roadmap may stretch into FY26

GST Council agenda includes tax relief for foreign airlines, and clarity on a host of items such as car seats

GST on insurance premiums: Karnataka in favour of exemption on products used by working class

Karnataka will propose a GST exemption on health and life insurance for the working and lower middle classes at the upco

Enhancing oversight: On the GST Council meet and issues

The GST Council could do more to smoothen the tax regime

Nitin Gadkari Wants States To Consider Cutting GST On Flex-Fuel Vehicles

Union Minister Nitin Gadkari on Monday said state finance ministers should consider reducing Goods and Services Tax (GST

GST Council To Review Online Gaming Taxation, Fake Registrations In Sept. 9 Meeting

The Council will also clear the notifications to give effect to the amendments in GST law, which were part of the Financ

GST council to discuss report on online gaming taxation, fake registration

The GST Council in its meeting next week is likely to deliberate upon the status report on taxation of online gaming, in

Why there is an urgent need to rationalise both GST slabs and rates

Rationalisation of the tax structure is expected to be discussed in the GST Council meet on Sep 9. The group of state mi

States are also cautious on GST rate cuts: FM Sitharaman

Finance Minister Nirmala Sitharaman remarked that states are cautious about implementing GST rate cuts, aiming to protec

GST Council meet to discuss rate rationalisation on September 9, final decision later: FM

Finance Minister Nirmala Sitharaman announced that the upcoming GST council meeting will address the rationalisation of

GST Council meet to discuss rate rationalisation on Sep 9, says FM

Finance Minister Nirmala Sitharaman on Tuesday said the GST council next month will discuss rationalisation of tax rates

The meeting is expected to address industry concerns, including clarity on tax rules for corporate guarantees and employ

GST payers with no valid bank account barred from filing GSTR-1 from Sept 1

GST taxpayers who do not furnish bank account details to GST authorities will be barred from filing outward supply retur

Derek O'Brien Urges Withdrawal Of 18% GST On Insurance Premiums Ahead Of Sept. 9 Meet

In a letter to Finance Minister Nirmala Sitharaman, O'Brien called urgent review of GST on insurance premiums at th

GST Council meet: TMC's O'Brien urges Sitharaman to withdraw 18% GST on insurance premiums

The 18% Goods and Services Tax (GST) on health and life insurance premiums is a burden on 45 crore Indians comprising th

TMC's O'Brien urges Sitharaman to withdraw 18% GST on insurance premiums

TMC leader Derek O'Brien has urged Finance Minister Nirmala Sitharaman to urgently review and withdraw the 18 per cent G

TMC leader urges Sitharaman to withdraw 18 pc GST on insurance premiums

New Delhi: TMC leader Derek OBrien has urged Finance Minister Nirmala Sitharaman to urgently review and withdraw the 18

DGGI drops 3,000 crore tax demand on 18 foreign shipping firms for FY18

The Directorate General of Goods and Services Tax Intelligence (DGGI) dropped a 3,000 crore tax demand for 2017-18 again

FM tells officers to effectively implement GST, keep positive attitude

The goods and services tax (GST) should be implemented effectively and officers should keep their attitude towards taxpa

India might retract its $4 billion tax demand on Infosys following intense lobbying and industry backlash. The tax notic

GST Rate Rationalisation Panel Discuss Cutting Taxes On Some Items

The suggestions of the GoM will be taken up on the Sept. 9 meeting of the GST Council headed by Union Finance Minister N

Infosys tax case: India open to resolving over Rs 32,000 crore tax dispute with Infosys

India is exploring ways to resolve tax disputes with major companies like Infosys and foreign airlines to avoid harming

GoM on rate rationalisation to meet 1st time ahead of GST council meeting

Ahead of the GST Council meeting on September 9, the Group of Ministers (GoM) on GST rate rationalisation will meet here

Group of Ministers on rate rationalisation meets ahead of GST Council meeting

The Group of Ministers (GoM) on GST rate rationalisation will meet on Thursday ahead of the GST Council meeting on Septe

Aim is to make civil aviation more people-centric

Kinjarapu Rammohan Naidu, 36, is one of the youngest ministers in the current government, managing the high-profile civi

IIT-Delhi, Anna University & several other institutes get GST notice

ET has learnt that the ministry is closely examining the issue and may soon escalate the matter to the Finance Ministry

GST Council set to meet on Sept 9, talks on rate rationalisation to kick off

As announced by finance minister Nirmala Sitharaman during the post-budget discussion in Parliament, the newly reconstit

GST Council To Hold 54th Meeting On Sept. 9

The last GST Council meeting ended with focus primarily on easing compliance burden on taxpayers.

GST Council to meet on Sept 9, to start discussion on rate rationalisation

The GST Council, chaired by Union Finance Minister Nirmala Sitharaman, will meet on September 9. The 54th Meeting of GST

54th GST Council meeting to be held on September 9

The 54th GST Council meeting will be held on September 9, 2024. Meanwhile, July GST collections rose 10.3% to over Rs 1.

Rejecting charges that Centre is pocketing GST on health insurance premiums, FM tells Rajya Sabha MPs that States benefi

Sitharaman Defends Budget As Parliament Passes Financial Bills

New Delhi: Attacking the Opposition on the growth of the Indian economy, Union finance minister Nirmala Sitharaman on Th

Opposition's walkout on GST issue a 'face-saver', says FM Sitharaman

Finance Minister Nirmala Sitharaman on Wednesday criticised the opposition parties for their walkout from the Lok Sabha

Oppn slams govt for not withdrawing GST on health, life insurance premiums

Opposition members in Lok Sabha on Wednesday slammed the government for not taking up an amendment in the Finance Bill t

Govt collects Rs 8,263 cr towards GST on health insurance premium in FY'24

The government accumulated Rs 8,263 crore in GST from health insurance premiums for the fiscal year 2023-24. There have

.png)

.jpg)